Resolution No. 125

A RESOLUTION REPEALING RESOLUTION NO. 119 AND ESTABLISHING FEES PERTAINING TO CERTAIN CITY SERVICES, PERMITS, AND APPLICATIONS OFFERED BY THE CITY AND REFERENCED WITHIN THE CODE OF THE CITY OF LINN VALLEY, KANSAS.

WHEREAS, the City of Linn Valley, Kansas, presently charges for a variety of services, permits and applications; and

WHEREAS, fees are currently set forth in the Code of the City of Linn Valley, Kansas, having been authorized and formulated by the City Council at different times throughout the history of Linn Valley; and

WHEREAS, administration of the various fees would be simplified if all such fees would be consolidated into one resolution where both city staff and the citizens of the City of Linn Valley could determine the fees charged by the City;

NOW, THEREFORE, BE IT RESOLVED BY THE GOVERNING BODY OF THE CITY OF LINN VALLEY, KANSAS:

Section 1. The following list of fees shall be charged for the appropriate service, permit or application, as referenced by the Code of the City of Linn Valley, Kansas:

|

FEE DESCRIPTION |

CODE SUBSECTION |

FEE AMOUNT |

|

Administration |

|

|

|

Open Record Inspection Fee |

1-612 |

Charged at the rate of $25 per hour per employee engaged in the record

search, or a minimum $25 charge per request |

|

Open Record Copying Fee |

1-613 |

$0.25 per page |

|

|

|

|

|

Animal Control |

|

|

|

Dog License Fees |

2-102 |

$3 fee per neutered male or spayed female dog; $8 for each intact male aor

female dog. $25 kennel fee for three or more dogs per household |

|

Overdue Dog License Fee |

2-104 |

$10 per dog if not fee is not paid within the time required |

|

Dog Tags |

2-202 |

$8 fee for duplicate tag to replace lost or stolen tag |

|

Dog Impoundment Fee |

2-124 |

$25 |

|

Dog Boarding Fee |

2-125 |

Boarding fee $20 per day in addition to other fines and fees |

|

|

|

|

|

Cereal Malt Beverage Licenses |

|

|

|

Cereal Malt Beverage License Fee |

3-207 |

(a) General Retailer - $25 per calendar year (b) Limited Retailer - $25 per calendar year |

|

Cereal Malt Beverage Location Change Application Fee |

3-211 |

$25 |

|

|

|

|

|

Building Permits |

|

|

|

Building Contractor Registration Fee |

4-103 |

$50 fee per calendar year |

|

Building Permit Application Fee |

4-202 |

$35 |

|

Building Permit Base Fee |

4-202 |

$75 |

|

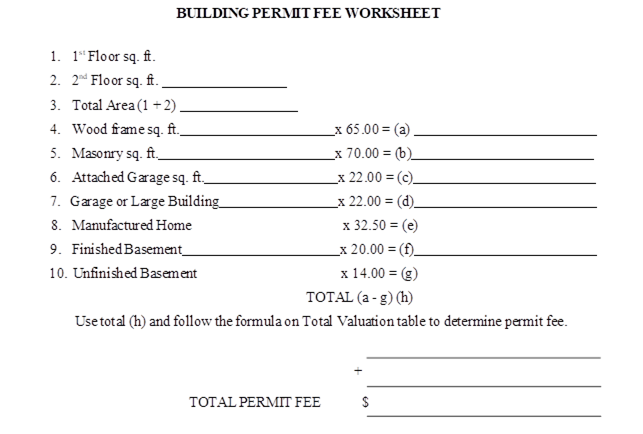

Building Permit Fees – New Residential, and Non-residential

Construction greater than 240 sq. ft. |

4-202 |

Calculated using Exhibit A worksheet |

|

Environmental Impact Fee |

4-202 |

$500 for each water holding tank and sewer holding tank, in addition to

the required permit fees. |

|

|

|

|

|

Public Sewer System |

|

|

|

Sewer Use Rates |

15-101 |

The first billing cycle in January 2024 monthly rate of $60.90; rates

will increase 2.5% annually. Billing cycle is 21st day of the month thru 20th

day of the following month. Payments are due the 9th of the month.

Payments not made by the due date will be charged a late penalty of $2.50 in

addition to payment due. |

|

High Volume Users Rates (250,000 or more gallons annual flow into city

wastewater treatment facility) |

15-101 |

Rate per 1000 gallons is $18.63; effective January 1, 2024, rates will

increase 2.5% annually. Payment is due the 24th of the month. Late penalty is 5% of

balance due. |

|

|

|

|

|

Replace missing or damaged vent cap |

15-207 |

$88.00 |

|

|

|

|

|

Replace missing or damaged control panel key lock |

15-207 |

$25.00 |

|

|

|

|

|

Public Sewer System Connection Fee |

15-209 |

$6,450 fee in 2024; annual increase 2.5% |

|

EXHIBIT A |

|

|

TOTAL VALUATION |

FEES |

|

$1.00 to $500.00 |

$25.00 |

|

$501.00 to $2,000 |

$25.00 for the first $500.00 plus $2.75 for each additional $100.00 or fraction thereof, to and including $2,000.00 |

|

$2,001.00 to $25,000.00 |

$62.25 for the first $2.000.00 plus $12.50 for each additional $1,000.00 or fraction thereof, to and including $25,000.00 |

|

$25,001.00 to $50,000.00 |

$349.75 for the first $25,000.00 plus $9.00 for each additional $1,000.00 or fraction thereof, to and including $50,000.00 |

|

$50,001.00 to $100,000.00 |

$574.75 for the first $50,000.00 plus $6.25 for each additional $1,000.00 or fraction thereof, to and including $100,000.00 |

|

$100,001.00 to $500,000.00 |

$887.25 for the first $100,000.00 plus $5.00 for each additional $1,000.00 or fraction

thereof, to and including $500,000.00 |

|

$500,001.00 to $1,000,000.00 |

$2,887.25 for the first $500,000.00 plus $4.25 for each additional $1,000.00 or fraction thereof,

to and including $1,000,000.00 |

|

$1,000,000 and up |

$5,012.25 for the first $1,000,000.00 plus $2.75 for each additional $1,000.00 or fraction thereof. |

|

Manufactured housing fees are 50% of

the fees for conventional housing. |

|

(12-11-2023)